The Press: Phat Dat Finalizes Due Loans

On 21st November 2022, Phat Dat Real Estate Development Corporation (HOSE: PDR) finalized a VND 120 billion loan from Mirae Asset. This is a stock-secured loan with PDR shares serving as collateral.

Previously, on 25th October 2022, Phat Dat also settled a similar VND 100 billion loan from this Korean financial group.

From early November 2022, PDR stock witnessed strong declines. Such a strong decrease, as explained by the Company, is due to investor sentiment turning cautious amid the instability of the economy and PDR’s shareholders with margin calls at securities companies undergoing forced sell.

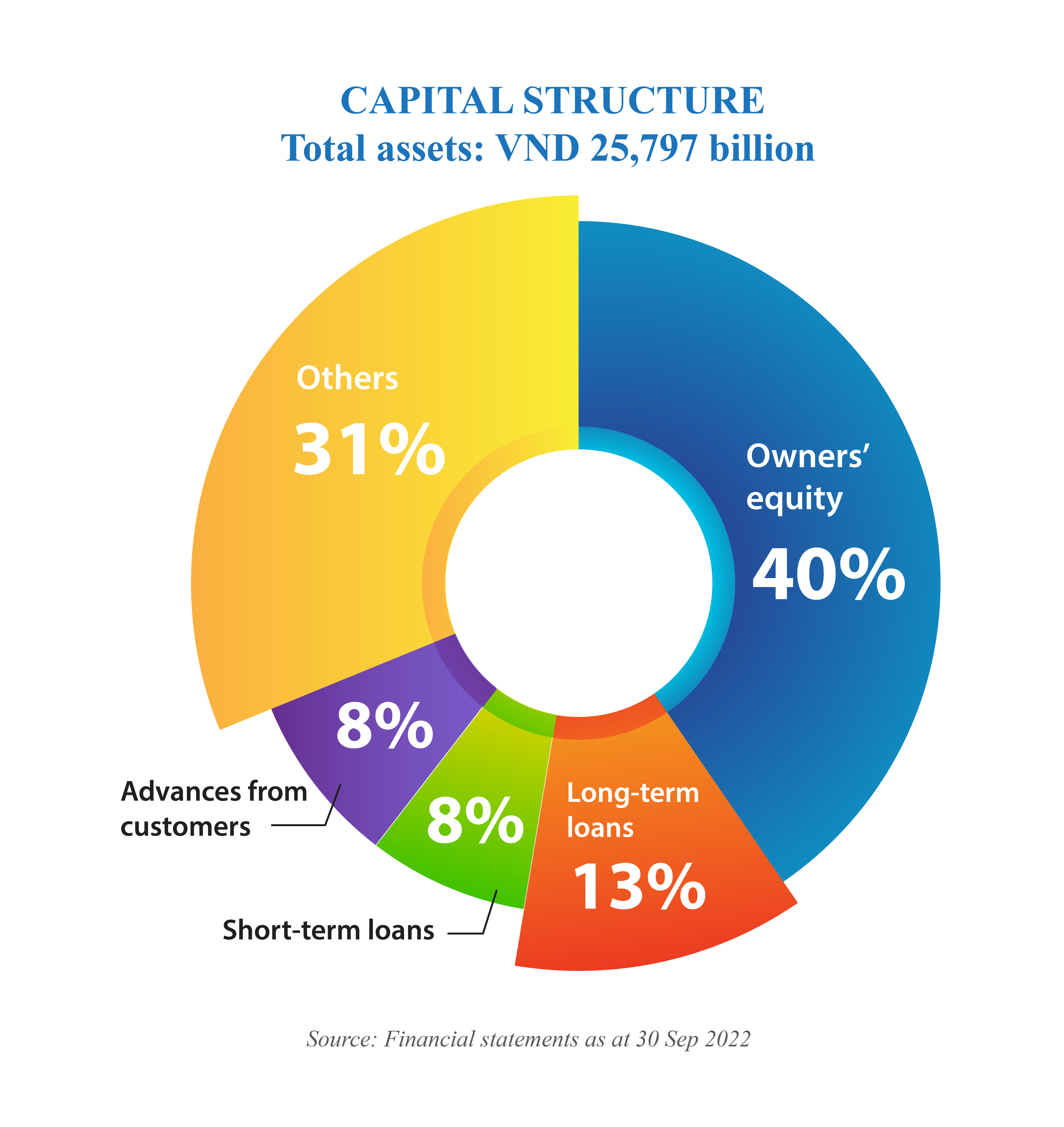

As of 30th September 2022, Phat Dat’s leverage ratio (Equity/Total Assets) was 0.40, with total assets of VND 25,797 billion. In fact, the leverage ratio is assessed at 0.49 after deducting inventory from the Everich 2 and Everich 3 projects recorded in the financial statements (the two projects were basically transferred, and PDR received the inflows). This actual leverage ratio is quite good for the real estate industry.

The outstanding obligations (with interest), which include loans and bonds, only make up roughly 21% of the Company’s capital structure. Additionally, Phat Dat has consistently paid back loan principal and interest on schedule.

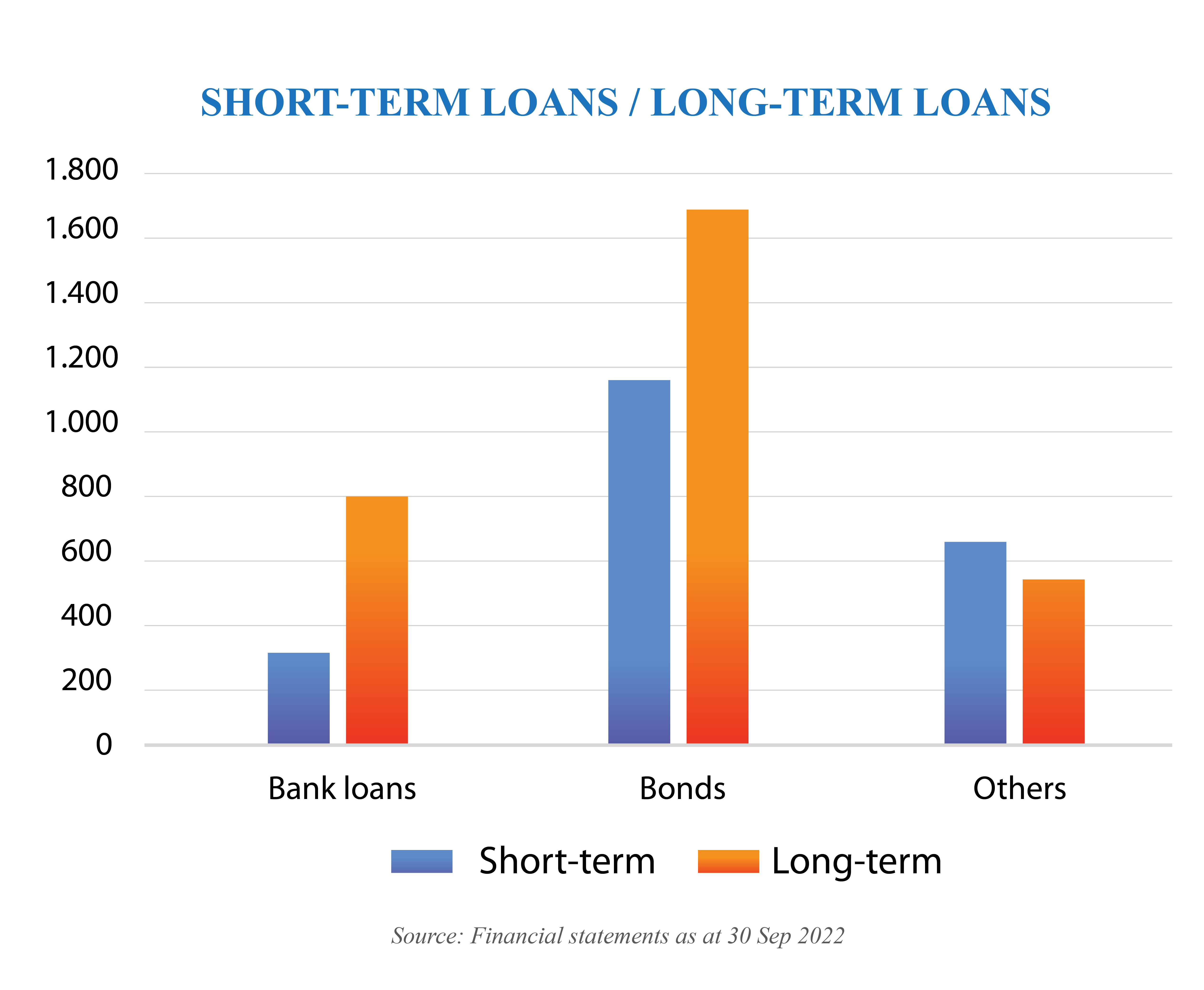

As of 30th September 2022, long-term loans and outstanding bonds accounted for 58% and 54% of Phat Dat’s loan structure, respectively. It is known that bonds issued by Phat Dat are secured with PDR shares of major shareholders. Because the value of collateral assets has plummeted recently, the Board has quickly approved adding more collateral, including PDR shares and other properties with ownership, exploitation and land use rights.

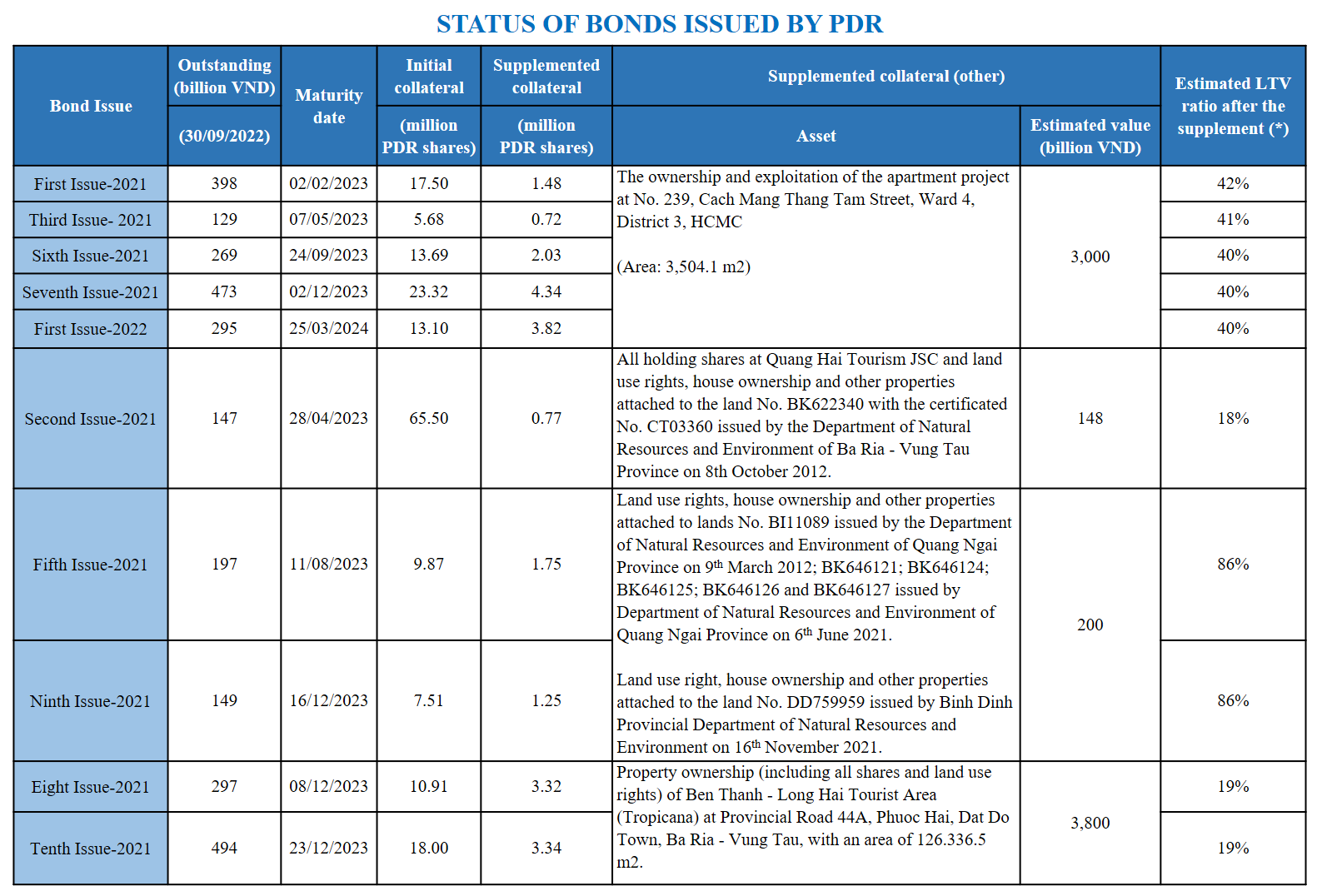

Specifically, AKYN Service Trading Investment JSC, a related entity of Chairman Nguyen Van Dat, used its property as collateral for the First, Third, Sixth, and Seventh Bonds issues in 2021 and the First Bonds issue in 2022. The property mentioned is the apartment project at No. 239, CMT8 Street, Ward 4, District 3, HCMC. This collateral is worth around VND 3,000 billion.

As such, after adding collaterals, the LTV ratio (bond balance/total collateral) is estimated at 40%. The estimated LTV ratio is based on total collateral, including real estate values and shares at VND 10,000 par value.

AKYN additionally consented to use all of its holdings in Quang Hai Tourism JSC, as well as its land use rights, home ownership, and other assets related to the land, as collateral for the Second Bonds issue in 2021.

The remaining bonds are secured by other assets owned by Phat Dat, including land use rights in Quang Ngai, Binh Dinh, and Ben Thanh Long Hai Tourist Area (Tropicana) in Ba Ria-Vung Tau.

After supplementing collateral, the bonds issued by Phat Dat maintained an estimated LTV ratio at a good level, ensuring financial obligations for bondholders and demonstrating Phat Dat’s ability to repay debts.

The majority of Phat Dat’s inventories include projects in Binh Duong, BR-VT and Binh Dinh, which are underway and expected to launch from 2023 onwards. This is the basis for Phat Dat to expect significant inflows in 2023 and the following years.

(*) LTV ratio is calculated from the outstanding bond value divided by the estimated total collateral value.

The value of shares used as collateral is calculated at VND 10,000/share.

The collateral asset used for multiple bond issues is assumed to be allocated proportionally to the outstanding balance of each issue.