Phat Dat Real Estate Development Corporation (PDR) Reports Second Quarter 2022 Financial Results, Maintaining Impressive Gross Profit

PDR’s business performance in 2Q2022 was impressive, with pre-tax profit reaching VND 516bn, up 60% over the same period last year.

Phat Dat Real Estate Development Corporation (HOSE: PDR) announced its interim financial statements for 1H2022. Accordingly, 2Q2022’s net revenue exceeded VND 853bn, an increase of 59% over the same period last year or 36% QoQ. 2Q2022’s pre-tax profit was VND 516bn, up 60% over the same period or 46% QoQ. 2Q2022’s revenue and profit primarily came from Zone 4’s high-rise section in Nhon Hoi Ecotourism City.

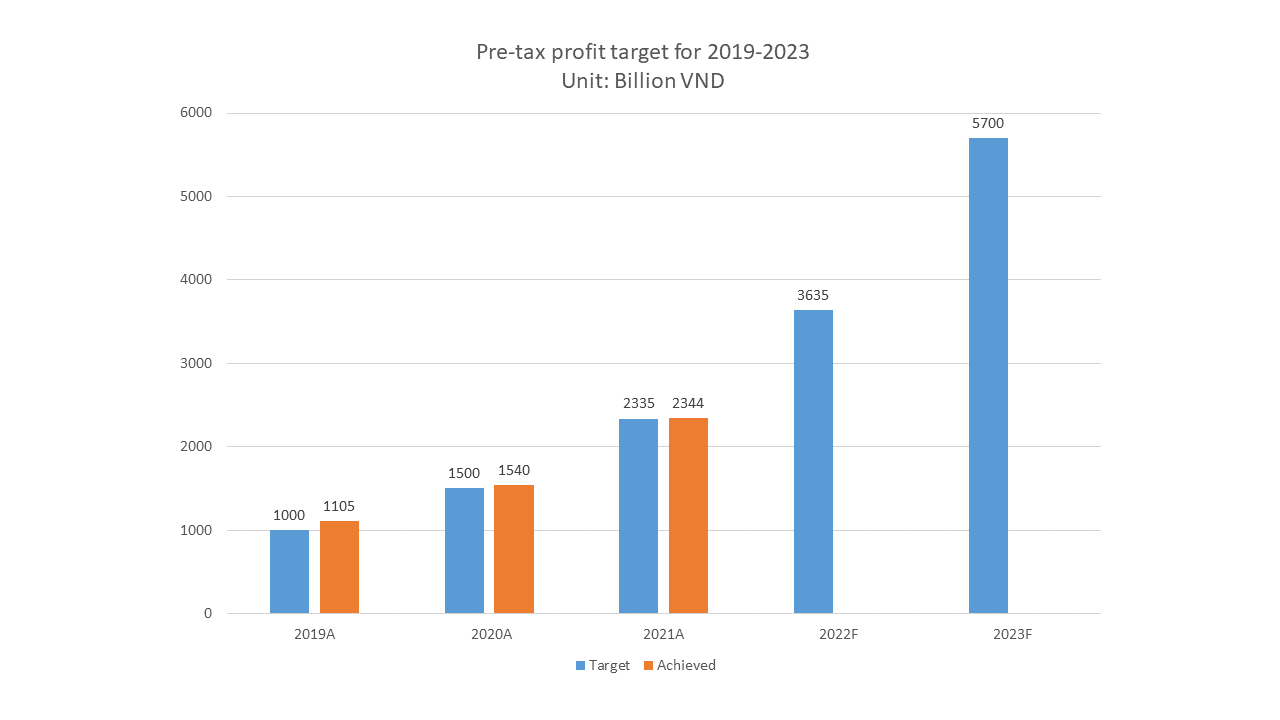

For the first half of 2022, Phat Dat recorded VND 1,479bn in revenue and VND 869bn in pre-tax profit, up 32% and 36%, respectively, over the same period of 2021. At the end of 2Q2022, Phat Dat’s total assets reached VND 23,518bn, an increase of nearly VND 3,000bn over six months.

Compared to the end of 2021, advances from customers increased by 30% to VND 2,204bn; cash and cash equivalents increased by 21%. Phat Dat’s net cash flow generated from operating activities during the period was VND 400bn.

Maintaining high gross profit margin in 2Q2022

PDR has achieved high investment efficiency thanks to its well-maintained gross profit margin. The wholesale strategy took its full effects, for the Company focused resources on project development and delivered remarkable business growth and investment returns.

Source: PDR’s financial statements

In June 2022, Phat Dat approved the transfer of shares in Saigon-KL Real Estate Corporation, which means the transfer of Astral City in Binh Duong. This deal is expected to bring VND 3,350bn inflow and thus, result in significant profit to be recorded in the third and fourth quarters of 2022. This large inflow provides PDR with adequate resources for new projects and maintains financial stability for the Company.

At the end of 2Q2022, Phat Dat recorded approx. VND 600bn in cash and cash equivalents, an increase of 71% QoQ. The quick ratio also improved markedly, rising to 0.56 from 0.35 at the start of 2022.

The real estate industry outlook remains positive based on the assessment of the following factors: young population, strong growth momentum of the national economy, and well-developed infrastructure. In the current context, PDR’s potential stems from its diverse land bank and project development competence.

In the coming quarters, Phat Dat expects to launch real estate products with an estimated market value of VND 33,000bn, mainly in Binh Dinh, Binh Duong and Ba Ria – Vung Tau. /.