Phat Dat reduces debts to lower than VND 1,260 billion

Owing to strong business growth and efficient capital allocation, Phat Dat has constantly made on-time or early debt settlements. As of 10th July 2021, PDR’s total debts went lower than VND 1,260 billion, while equity reached nearly VND 7,100 billion.

Along with the consistent developmental strategy and sustainable internal forces, efficient loan allocation has laid the groundwork for years of such PDR’s remarkable growth. Particularly, capital mobilized from credit institutions and investment funds has been well allocated in projects with high profitability and quick capital recovery, namely Zone 2, Zone 4, and Zone 9 in Nhon Hoi Ecotourism City (Binh Dinh Province), Astral City – the luxury apartment & commercial complex (Binh Duong Province), etc.

Profit and revenue from business activities have increased constantly over the years, paving the way for PDR to actively carry out major M&A deals as well as debt settlements and restructure.

Accordingly, PDR’s short-term debts fell to VND 350.95 billion by 10th July 2021. In detail, PDR has settled VND 1,283.55 billion of short-term debts in 2Q2021, including the payments of VND 521.55 billion to Vietnam New Urban Center LP Fund; VND 350 billion to domestic banks and institutions; VND 405 billion of bond redemption; and at the same time, PDR has fulfilled all bond obligations issued in 2019 and 2020; etc.

Also, outstanding long-term debts stood at VND 905 billion by 10th July 2021, of which VND 680 billion worth is bonds issued in 2021, and VND 231 billion worth of debts is to invest in the construction of the Company’s office.

In PDR’s balance sheet, there are long-term payables of VND 5,547.43 billion related to the transferred EverRich 2 and EverRich 3, which in fact are not PDR’s obligations. The two projects were transferred along with their responsibilities and interests to the partners in 2019 for continuous development, and PDR received the related amount accordingly. Therefore, upon completing legal procedures per laws, this amount will be recorded as revenue; The EverRich 2 and The EverRich 3 will no longer be included in the inventories or PDR’s liabilities.

Indeed, as of 10th July 2021, PDR’s actual liabilities totaled less than VND 1,260 billion.

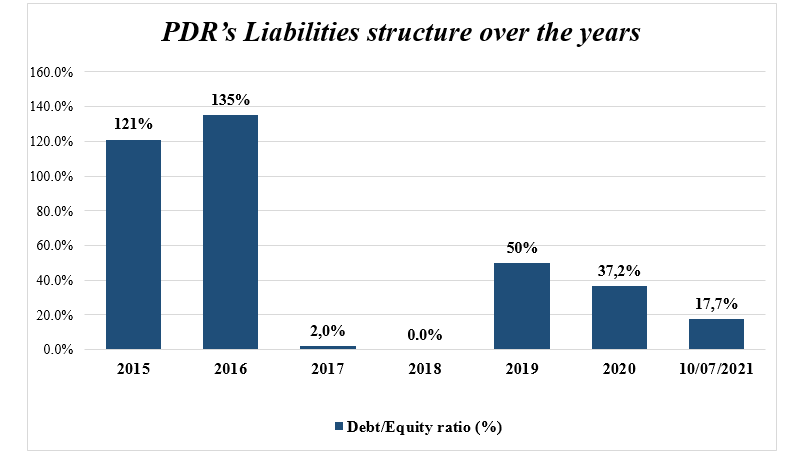

(PDR’s Liabilities structure over the years and as of 10th July 2021).

Meanwhile, PDR’s equity climbed to nearly VND 7,100 billion, pushing the debt to equity (D/E) ratio down to 17.7% – much lower than the average D/E ratio of enterprises with the same size in the real estate industry, which is 77.2% (estimated in the first quarter of 2021).

The debt to equity (D/E) ratio lower than 1/5 indicates relatively low leverage and, thus, more room to increase debts to fuel growth. Additionally, PDR enjoys credit upgrades amongst investors and institutions thanks to its well-earned reputation in the market, strong business performance, and on-time, even early, debt settlements. Obviously, PDR can proactively mobilize new resources to fund the projects that bring about high-profit prospects and stable cash flow in the coming time.