PDR - 2021 Business results recorded outstanding growth

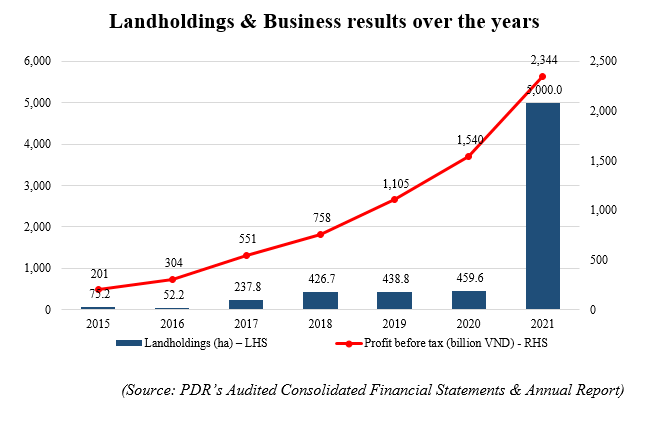

Phat Dat Real Estate Development Corporation (Stock code: PDR) has just released its 2021 financial statements audited by Ernst & Young Vietnam (one of the Big 4 leading auditing firms), which once more affirms PDR’s impressive performance with profit before tax surpassing VND 2,344 billion, up 52.2% YoY. Basic earnings per share (EPS) in 2021 reached VND 3,656/share, up 49.6% YoY, generating significant added value for shareholders and investors.

PDR rose to the top four most lucrative real estate developers on the stock market in 2021.

According to the clean F2021 financial report, PDR’s net revenue reached VND 3,620.2 billion (-7.4% YoY), profit before tax reached VND 2,344.4 billion (+52.2% YoY), and profit after tax reached VND 1,860.6 billion (+52.5% YoY). Thus, PDR completed 100% of 2021’s business plan approved at the annual general meeting of shareholders.

These results made PDR one of the Top 4 real estate stocks by 2021’s profit before tax on the Vietnamese stock market and the only four companies with a pre-tax profit exceeding VND 2,000 billion.

This achievement resulted from the Company’s strategic shift to segments and markets with better capital turnover to make the most of market opportunities.

Growth comes with a strong and increasingly optimized financial structure

In 2021, besides high growth, PDR always paid great attention to its financial health by improving capital flow and financial indicators. Short-term assets at the end of 2021 reached VND 15,337 billion (up 40.3% compared to the end of 2020) mainly because PDR actively invested in expanding landholdings for future development.

Cash and cash equivalents increased sharply from VND 53.2 billion at the end of 2020 to over VND 494 billion by 2021.

Inventories also saw a positive change in 2021 with a decrease from VND 1,473.8 billion to VND 393.1 billion because PDR recorded revenue in the low-rise section in Nhon Hoi Ecotourism City, Binh Dinh Province. Meanwhile, the increase mainly came from PDR’s key projects, including Binh Duong Tower (VND 1,598.5 billion); Senerity – Phuoc Hai (VND 1,375.8 billion); Astral City (VND 328.3 billion), and Bac Cuong – Tran Phu Da Nang (VND 630.0 billion). These projects have positively progressed and will generate incomes in 2022 and 2023.

Long-term assets reached VND 5,214.8 billion at the end of 2021 (11.2% YoY) because PDR continued its capital contributions to property developers and affiliates to implement projects.

Total liabilities increased to VND 12,407.4 billion, up 19.0% compared to the end of 2020; however, the ratio of liabilities to total capital decreased sharply from 66.7% in 2020 to 60.4% in 2021, reflecting PDR’s healthier debt structure.

Equity increased sharply by 56.8% YoY to VND 8,144.5 billion thanks to the accumulated undistributed profit at VND 1,875.2 billion.

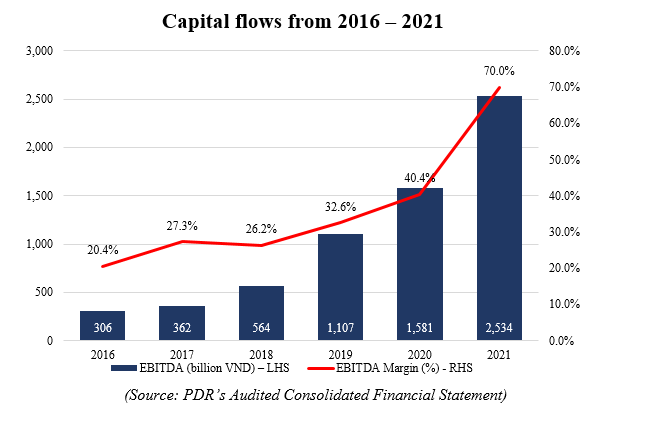

Earnings before interest, taxes, depreciation, and amortization (EBITDA) increased over 8 times from 2016 to 2021, with the EBITDA Margin increasing sharply from 20.4% in 2016 to 70.0% in 2021. At the end of 2021, the EBITDA/Interest expense ratio reached 16.1 times, a safe figure in PDR’s ability to meet financial obligations.

PDR’s development is constantly recognized by prestigious organizations at home and abroad

In 2021, PDR was honored by various real estate valuation associations such as Top 10 Developers in Vietnam for both 2020 and 2021 under the framework of the BCI Asia Award; Top 50 Vietnam’s Best-performing Companies in 2021 voted by Forbes; Top 10 prestigious real estate investors in 2021 by Vietnam Report, among others.

Currently, Phat Dat is a constituent of major and reputable indices at home and abroad, including VN30-Index, VanEck Vectors Vietnam ETF (VNM ETF), Fubon FTSE Vietnam ETF and FTSE Vietnam Indices, and the most recent MSCI Frontier Markets Index on 12th November 2021. Besides, other international ETFs such as Premia MSCI Vietnam ETF, iShare MSCI Frontier 100 ETF, S&P Select Frontier ETF, etc., are currently holding Phat Dat shares with their investment allocation strategy into Vietnam’s leading stocks.

Previously in October, Fitch Ratings – one of the three largest and most reputable credit rating agencies worldwide, assigned Phat Dat’s IDR at “B” – Outlook Stable.

Thus, PDR’s 2021 audited financial statements have reaffirmed its impressive achievements during the past year, building up confidence and motivation for shareholders and investors to accompany the Enterprise to conquer higher goals in the future.